Debt Snowball vs. Debt Avalanche in Canada

Debt repayment can be an overwhelming journey, especially when you’re faced with mounting debts and limited resources. Fortunately, there are various strategies to help you regain financial control, and two popular methods are the “Debt Snowball” and the “Debt Avalanche.” In this article, we’ll delve into these two debt repayment strategies and explore how Credit Dispute’s debt settlement service can be a valuable alternative to bankruptcy or a consumer proposal.

Understanding Debt Snowball

Debt Snowball is a debt repayment strategy popularized by financial guru Dave Ramsey. The concept behind it is simple: you pay off your debts from the smallest balance to the largest, regardless of interest rates. Here’s how it works:

- List Your Debts: Start by listing all your debts, from the smallest to the largest, regardless of interest rates. This step provides a clear picture of what you owe.

- Minimum Payments: Continue making minimum payments on all your debts except the smallest one.

- Extra Payments: Allocate any extra funds you have to pay off the smallest debt aggressively. This could mean cutting back on non-essential expenses or finding additional sources of income.

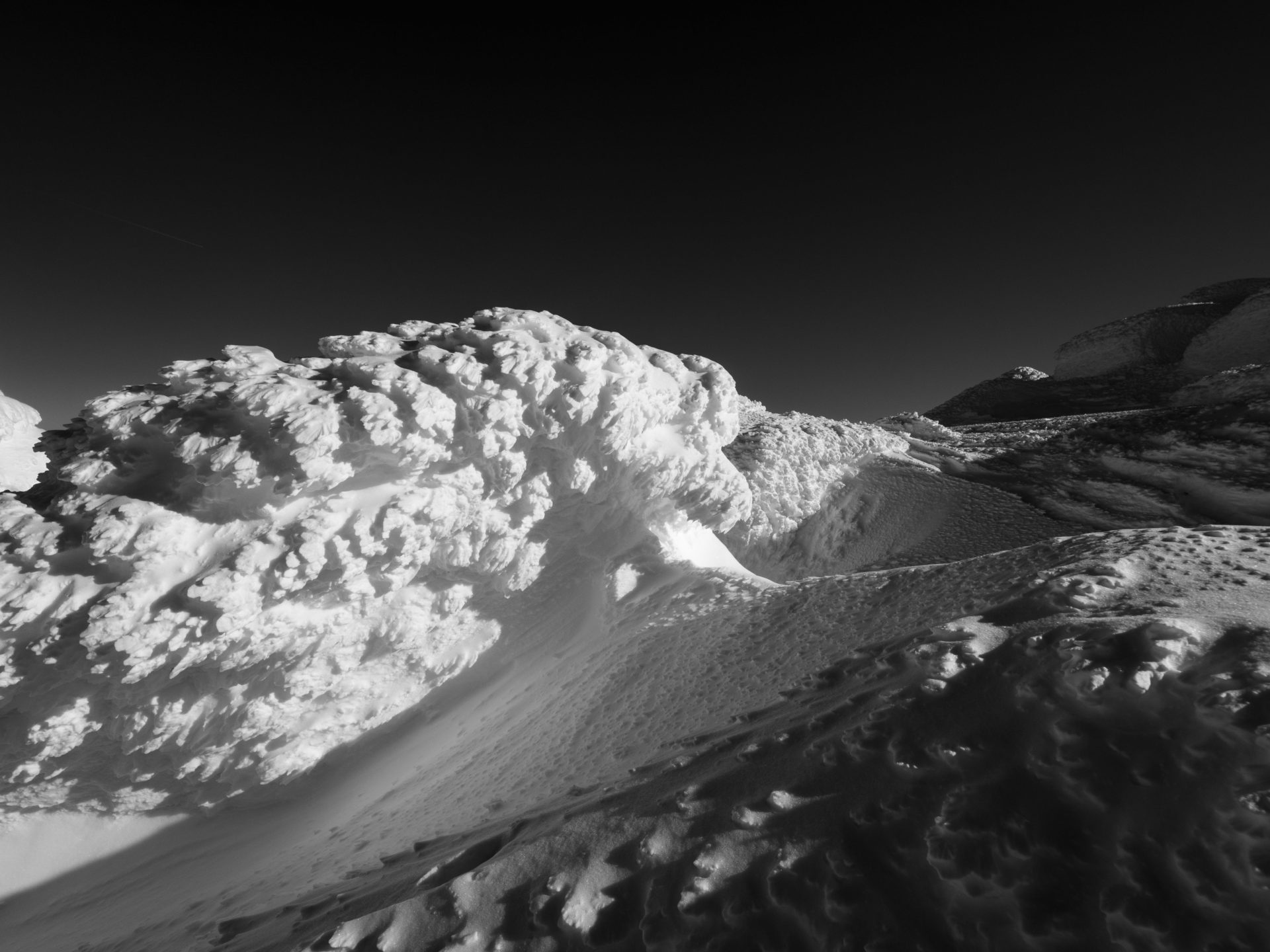

- Snowball Effect: As you pay off the smallest debt, you gain a psychological victory. The feeling of accomplishment motivates you to tackle the next smallest debt and so on, creating a “snowball effect.”

The Debt Snowball strategy focuses on the psychological aspect of debt repayment, providing a sense of accomplishment as you eliminate smaller debts one by one. This method can be especially effective for those who need motivation to stay on track.

Exploring Debt Avalanche

Debt Avalanche, on the other hand, takes a more financially logical approach. In this method, you prioritize paying off debts with the highest interest rates first, regardless of the balance. Here’s how it works:

- List Your Debts: As with the Debt Snowball, start by listing all your debts, but this time order them from the highest to the lowest interest rates.

- Minimum Payments: Continue making minimum payments on all your debts except the one with the highest interest rate.

- Extra Payments: Allocate any extra funds you have to pay off the high-interest rate debt aggressively.

- Avalanche Effect: By targeting the highest interest rate debt, you minimize the overall interest you pay over time, saving you money in the long run.

Debt Avalanche is financially efficient, as it minimizes the amount of interest you accrue while paying off your debts. It’s a strategic approach for those who want to optimize their financial resources.

Debt Snowball vs. Debt Avalanche: Which One Is Better?

Now that we’ve explored both methods, you may wonder which one is the right choice for you. The answer depends on your financial situation and personal preferences. Here are some key points to consider:

- Debt Snowball: This method provides a psychological boost early on as you quickly eliminate smaller debts. It’s an excellent choice if you need motivation and a sense of accomplishment to stay committed to debt repayment.

- Debt Avalanche: If you want to minimize the total interest paid and save money in the long term, the Debt Avalanche is the more financially efficient option. It may require more discipline, as the initial victories may not be as noticeable.

- Credit Dispute’s Debt Settlement Service: Regardless of whether you choose the Debt Snowball or Debt Avalanche method, it’s important to have a support system in place. Credit Dispute offers a debt settlement service that can help you negotiate with creditors, reduce your overall debt, and create a manageable repayment plan.

By choosing Credit Dispute’s debt settlement service, you can explore an alternative to bankruptcy or a consumer proposal. Our experienced professionals will work with you to develop a personalized debt relief plan, taking your financial situation into account. We aim to help you regain control of your finances and achieve a debt-free future.

Don’t let the burden of debt hold you back. Take the first step towards financial freedom by applying online for Credit Dispute’s debt settlement service today.

In conclusion, both the Debt Snowball and Debt Avalanche methods have their merits, and the choice between them ultimately depends on your financial goals and personal preferences. Whichever strategy you choose, Credit Dispute’s debt settlement service can provide the support and guidance you need to overcome your debt challenges and embark on a path toward financial freedom. Apply online today and take the first step towards a debt-free future.